TACIR Releases New Report on Electric Vehicles

Update: January 11, 2023 - A previously unreleased report from TACIR on electric vehicles was released in mid-January to highlight the issues affecting roads and highways funding in Tennessee. You can view that newly released report here.

December 2022 - A new Tennessee report appears to lay the groundwork for how the state General Assembly might treat electric vehicles (EVs) as they affect revenue streams for state and local governments. The Tennessee Commission on Intergovernmental Relations (TACIR) just adopted its report “Electric Vehicles and Other Issues Affecting Road and Highway Funding in Tennessee” and addressed many of the revenue concerns county officials have been expressing as fuel tax revenues have waned for the past several years.

As fully electric vehicles grow in the automobile marketplace and do not use gasoline or diesel fuel, not paying motor fuel taxes that are the source of revenue for the majority of transportation projects at the state and local levels, they are one of the reasons for flagging collections.

“In 2022, the net loss in state road funding attributable to EVs was approximately $1.7 million; this includes forgone gas tax revenue, offset by EV registration fees,” according to the report. “Using historic trends, TACIR staff projects the net loss will continue and grow, reaching $10 million in 2030 and $27 million in 2040. Using forecasts for increased EV adoption, staff projects those losses increase to $16 million in 2030 and $52 million in 2040.”

The report makes a keynote about other factors, including fuel efficiencies of newer automobile models and inflation, that are also having a major impact on how far fuel tax revenues can go.

“Beyond this potential for reduced gas tax revenue, inflation significantly decreases the purchasing power of revenue collected,” TACIR reported. “Tennessee’s gasoline and motor fuel taxes are flat amounts based on volume sold, not price. This means that gasoline and motor fuel tax revenue will not necessarily keep up with inflation when prices increase.”

When the IMPROVE Act was implemented beginning July 2017, it was viewed as a temporary way to address revenue declines at that time.

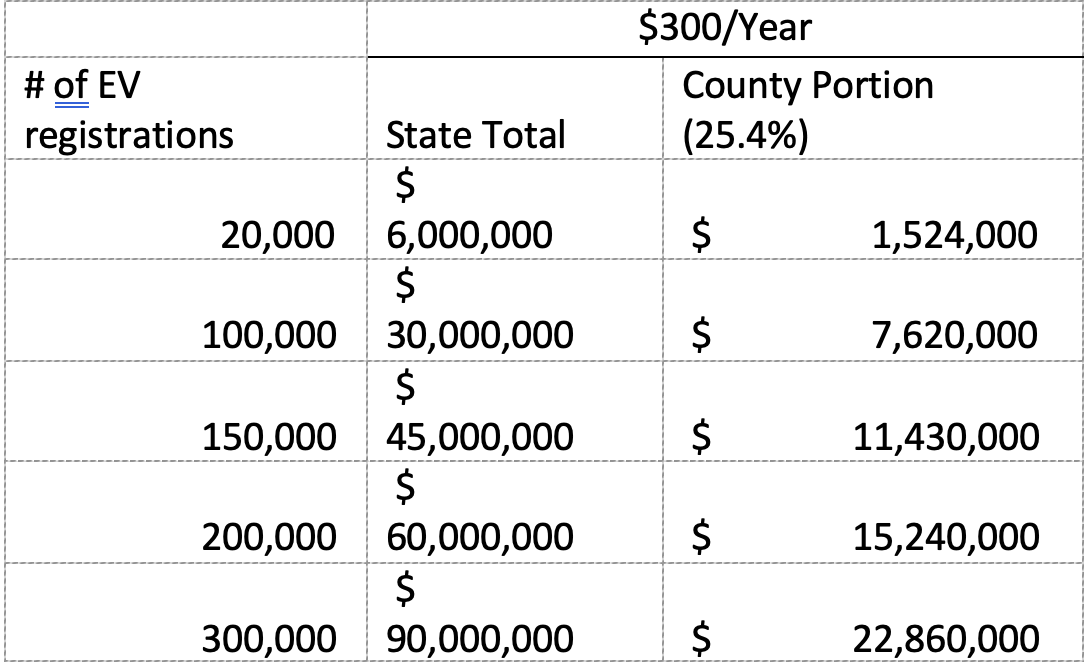

The Lee Administration last month rolled out its “Build With Us” initiative, proposing public private partnerships, implementation of interstate express lanes and an increase in EV registration fees. While the TACIR report supports an increase in those registration fees from the current $100 each year, the governor’s proposal calls for an increase to as much as $300 a year. Advocates say the increase is simply a way to make users of roads throughout the state pay an equitable amount to maintain the transportation infrastructure.

“As the state confronts the tradeoffs associated with any potential alternatives to its current fuel-tax-based road funding framework, the Commission recommends the state balance the ability to raise adequate revenue with equity for all drivers regardless of whether their vehicles are powered by gas, electricity, or some other method; ensure that revenue from any adopted alternatives is shared with local governments in an equivalent manner to the current sharing of fuel taxes; and ensure any alternatives intended to offset lost revenues are designed to do so without discouraging customers from purchasing electric vehicles,” according to the final report.

TACIR members approved the report, with a single change, asking TACIR staff for a recommended range for such an increase “plus or minus 5 percent.” The range would give legislators some validation in what they propose in the next session. It would also include a rate that would be a lesser charge for plug-in hybrid vehicles, which operate on both fuel and electrical charges.

County highway departments are particularly interested in the way the annual EV registration fee might be shared with them as a replacement revenue source to current fuel tax revenues. The recommendation from TACIR states that the EV fee should be shared “with local governments in the same proportion as the gas tax,” something that could have a huge impact on county roads and bridges. No part of the current EV fee goes to local governments.

Lost revenues are already having an impact on counties, so finding a replacement funding source that would likely grow over time is an important factor in any solution the General Assembly could consider.

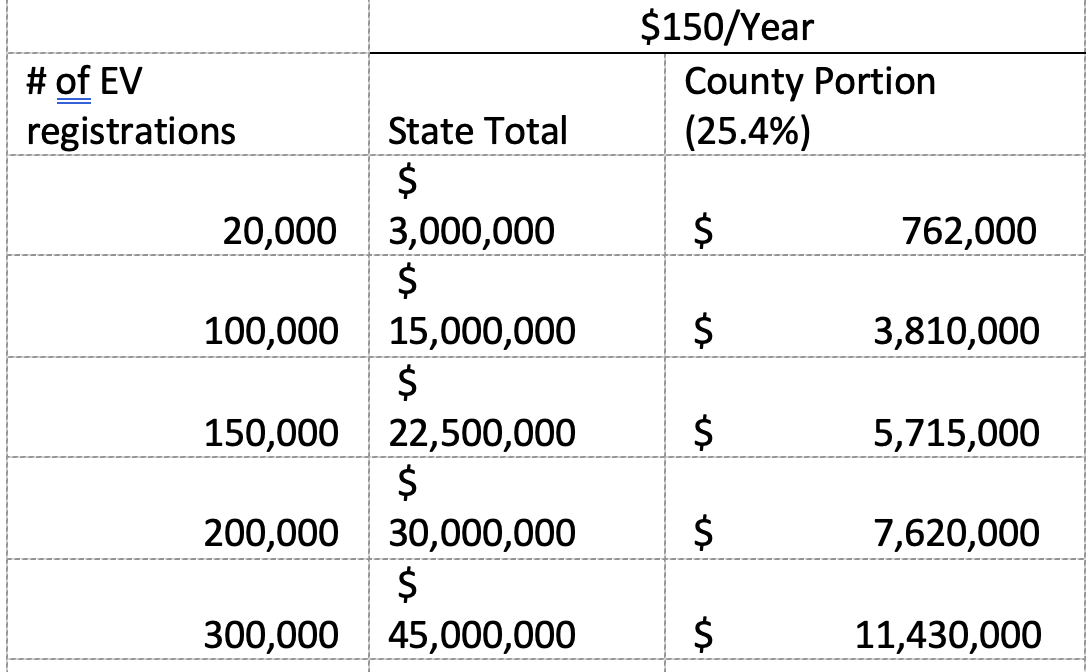

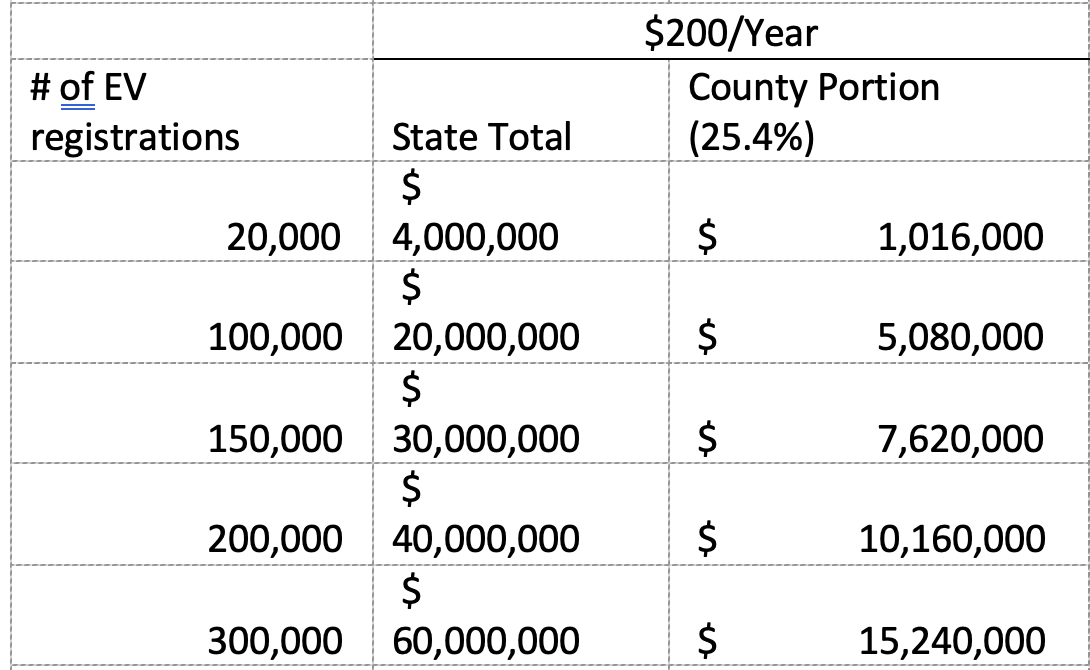

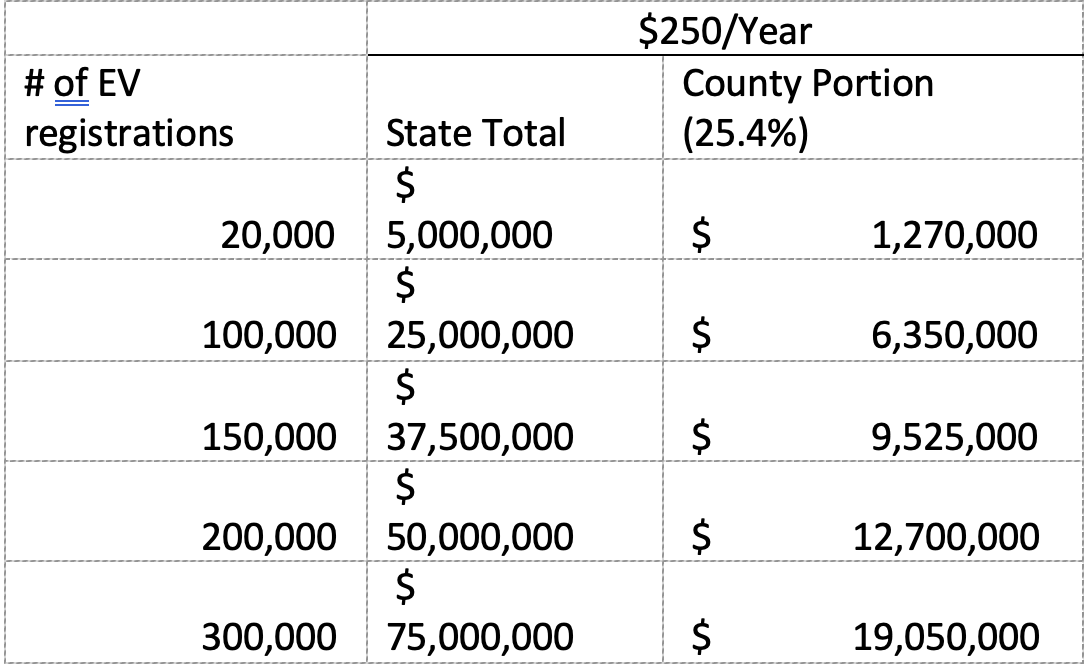

Currently, the state shares 25.4% of total state gasoline and motor fuel collections with counties for road and bridge maintenance. There are now about 20,000 fully electric vehicles registered in Tennessee. If that EV fee is raised to $150/year and shared with counties, the annual county portion would be about $762,000. Obviously, if the fee were raised to $300/year, the county portion would go to more than $1.52 million annually. As EV popularity grows, 100,000 registered EV's would generate between $3.8 million and $7.6 million a year, at $150/year and $300/year, respectively.

As the governor and legislature work to address the “Build With Us” initiative, they would have to elect to take up the revenue sharing issue for it to become a reality for counties. Subscribe to the TCSA E-newsletter for more updates on the EV fees and taxation news as they become available from the TN General Assembly.